Updated financial data will be a requirement to obtain a company loan. Let's make it simple.

War, recession, skyrocketing electricity prices and a growing number of bankruptcies. It's hard not to get caught up in the constant reminders of these worries, both in the media and in your own performance. Amidst all this, many companies need to borrow capital and lenders need to lend capital with as little risk as possible. Data needs to be up-to-date. Annual reports that are up to 14 months old are simply no longer good enough.

Financial data must be shared securely through, for example, an Open Finance solution such as Zwapgrid API.1 where the business owner simply gives their approval and the lender can access the data needed. It has to be simplified here and now.

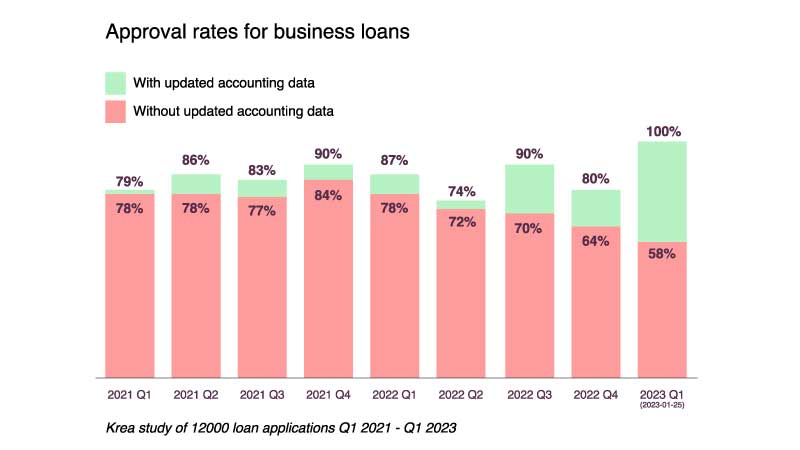

We have read a study released today by the finance solution comparison service Krea, which speaks a clear language. They base their study on 12,000 applications and some 30 finance solutions who are linked to their service.

Updated accounting data is the key

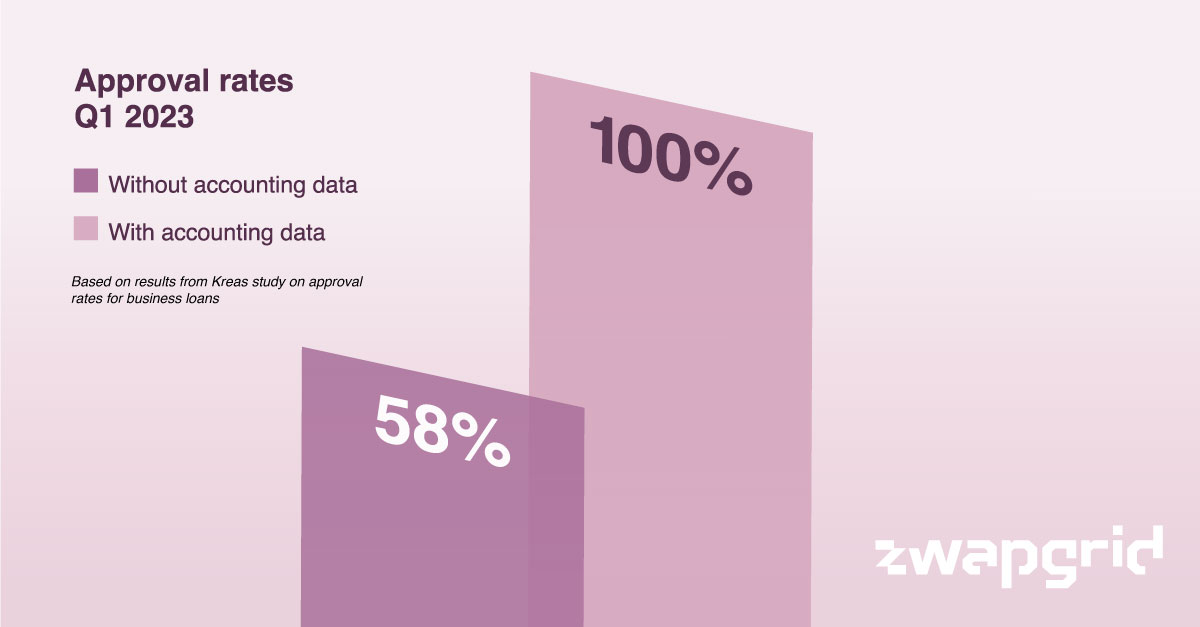

According to Krea's study, the chance of getting a loan increased from 70% to 90% in Q3 2022 if you could provide updated accounting data, and so far this year, the chance increased from 58% to 100%.

However, those who applied with updated accounting data are significantly fewer than those who applied without, so this obviously affects the results. We can also see that there are a number of financing options not included in the survey where the entrepreneur has to disclose their accounting data, otherwise no loan is given at all.

Open finance solutions such as Zwapgrid will be necessary

Admittedly we are only at the beginning of Q1 2023 but the trend is that lenders need updated accounting data and have to simplify the process in a secure way. Open finance services such as Zwapgrid's API.1 stands apart from other alternatives by removing the need to spend development hours on understanding, building and maintaining integrations to many different financial systems. At the same time Open finance with Zwapgrid API.1 provides a smooth, safe and secure way for the business owners to share their data without complex onboardings and unnecessary risks.

Open finance with Zwapgrid API.1

Carsten Leth, CCO at Krea, who conducted the study, tells us about his findings.

Why is it important for companies to share up-to-date numbers?

"Lenders today are more conservative in lending capital to companies that can only show outdated data. This is a natural development that has arisen as data has become more available through Open Finance solutions such as Zwapgrid's API.1 or through updated SIE files. Lenders want to be able to see what is happening here and now, as well as what has happened in the last year. If that information is not included in an application, the probability of rejection increases," explains Carsten.

How much difference will it make?

"In general, a loan application that had updated accounting information was 10 percent more likely to be approved. Not only that, they also received 12 percent higher approved amounts.

That's how it looked until Q3 2022 when the requirements increased substantially. We then experienced increased uncertainty in both the global economy and locally. Many companies did not keep up and did not include updated figures. If the trend continues, we will of course sooner or later reach a point where updated accounting data must be included in one way or another," Carsten concludes.

Next steps

Now that you know what the numbers say. Let's be clear. In 2023, lenders need to start the transition to more up-to-date data through Open Finance. Read more and get in touch with us at Zwapgrid.

How Open finance with Zwapgrid API.1 works?

Author: Magnus Serratusell Wallin