Launch! A unified API that will help fintech companies get access to customers' financial data in the Nordics

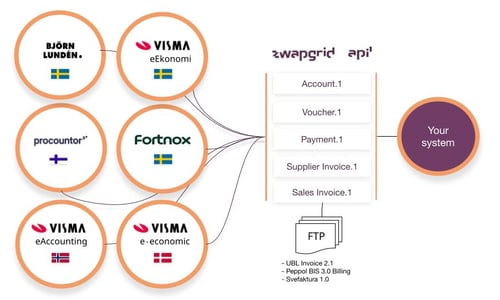

Zwapgrid challenges the way fintech companies gain access to their customers' financial data in a unified way to, for example, make better credit assessments, offer the right terms or automatically bookkeep invoices that have been paid. With our new service, Zwapgrid API.1, we offer access to data for the most common financial systems in the Nordics in a unified way where fintech companies can build their own experience and develop their offering through Zwapgrid's API.

A new way to access business customers' financial data

With our new service, Zwapgrid API.1, our partner companies can develop services using their customers' data from different systems. In the past, these projects have been large, costly and resource-intensive. Our new API service is initially aimed at companies with financial data needs. There we can see that the need to have access to data for risk assessment and different types of financing is high and will increase as more companies look for alternative financing solutions in more turbulent times.

1.7 billion invoices with the most relevant systems

Only in the Nordics we estimate that we could provide access to for example around 1.7 billion invoices with the systems that we connect. A great stream of data to tap into for those that understand how they can use the data to innovate and provide for example financing.

Everything is done in a secure way where the finance company's customer gives consent to retrieve specific data. At Zwapgrid, we handle the consent and the actual transport of the data, but we don't store it or do anything with it, we act as an infrastructure. Our customers own the experience, product innovation and the relationships to their customers.

Read more about Zwapgrid API.1

Last year we signed a number of deals with large companies such as Nets, Kivra and Björn Lundén. This has gone well, but we also discovered that there was a huge need in the fintech industry, among others, for financial data. To make it easy for them to access their customers' financial data, we chose to create an API on top of our network that lets them build their own experience more easily using our unified API as a foundation. We're taking a lot of the technical stuff out of the equation. Fintech companies build against our API themselves.

Rapidly growing demand

Many companies are looking for other means of financing than traditional loans or venture capital. This is reflected in the fact that several new challengers have entered the market in a short period of time to meet the increased demand.

Several other factors, such as global turmoil, the recession and tough demands on lenders, make it more important than ever to have really good data to rely on. It all points to the fact that what we provide is more relevant than ever, now and in the future.

Keeros choose Zwapgrid API.1 for their platform

One of Zwapgrid's first customers for Zwapgrid API.1 is the Keeros Finance platform. They in turn offer many finance companies and banks their own service, Keeros Finance.

"We have chosen Zwapgrid's unified API for finance. It's a convenient way for us to offer everyone who uses Keeros Finance their customers' financial data. I would say it will be important and a major competitive advantage going forward if we and the users of our platform are to grow at the same pace as demand increases and offer exactly the kind of solutions that are needed in a rapidly changing market. We have always been committed to offering agile and smart solutions. By using Zwapgrid and its unified API, we can create exactly the experience we want, without having to build and maintain a large amount of integrations ourselves," explains Krister Keskitalo, Founder, Keeros.

We dont store the SMB customers financial data

All the fintech companies we are talking to now have in common that, like Keeros, they are looking at ways to make development more efficient. No one wants to disrupt internal developer teams with something that is not core business. Those at the forefront want to quickly look at our API documentation and start developing, they know exactly what they need to do. Others need more help to get started, and we can offer assistance. What they all have in common is that they don't want us to do anything more with their customers' data than transport it from other systems to theirs.

Join the grid for nordic SMB data

We transport the data securely to the right system, at the right time. We have a roadmap with our partners. Going forward, we will be able to quickly reach multiple systems, markets and types of data. So it can be valuable to join now for those who want to be a part of our journey with Zwapgrid API.1.

Read more about Zwapgrid API.1